I don’t have time for a real blog post, but here’s a quickie

in an attempt to keep this blog alive.

Dave Altig and Mike Bryan of the Atlanta Fed’s Macroblog

argue here that it wouldn’t make much difference if the Fed

were doing price level targeting (in which the future target path stays fixed

even when you miss a target, so you need catch-up inflation or catch-up

disinflation) rather than inflation targeting.

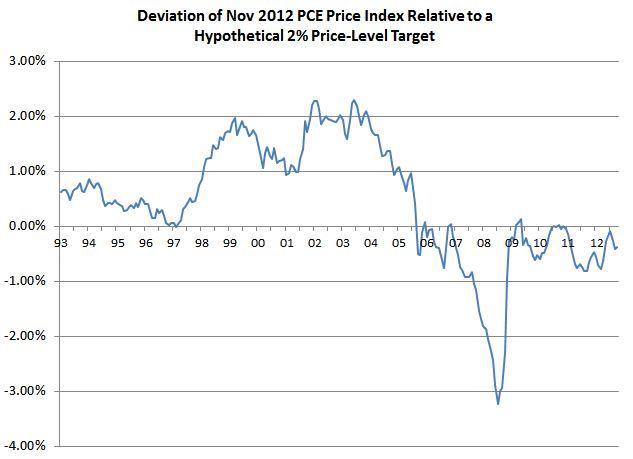

Their evidence is mostly from a chart like this (my replication using

monthly data, which you can confirm looks fairly similar to theirs which

appears to use annual data):

Quoting from their blog post:

Consider the first point on

the graph, corresponding to the year 1993….This point on the graph answers the

following question:

By what percent would the actual level of the personal consumption expenditure price index differ from a price-level target that grew by 2 percent per year beginning in 1993?

The succeeding points in the

chart answer that same question for the years 1994 through 2009.

In my case, as I said, it’s

monthly, and it goes all the way to 2012, but the idea is the same.

OK, fine. So here it looks like a price level target

would have produced roughly the same results as the Fed’s (unofficial until

January 2012) inflation target, and whether it would have undershot or overshot

depends on when you start the target path.

In particular, people who argue that we are undershooting right now

don’t seem to have much of an argument unless they start the target path in

2008 or later.

BUT…

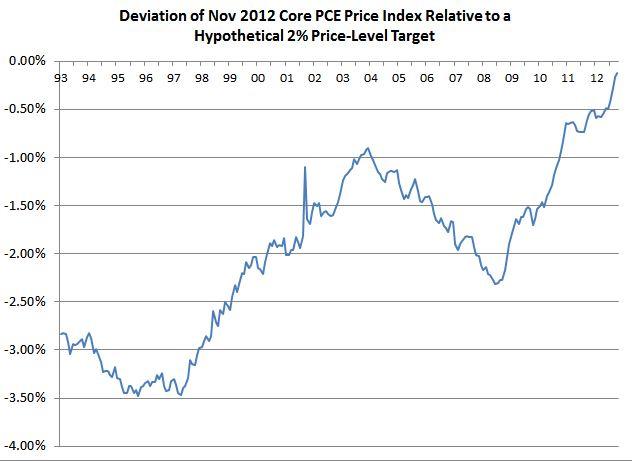

The problem with this chart is that

it uses the headline PCE price index, whereas during most of this time (until

January 2012 when the official inflation targeting policy was introduced), the

Fed was perceived to be targeting core

PCE inflation (excluding food and energy, that is), not headline

inflation. Price-setters were making

their decisions largely under that assumption.

It makes no sense to go back to 1993 and set up a target path using the

headline price index when that index was irrelevant to the policy that the Fed

seemed to be following at the time.

Moreover, targeting the price level

using the headline price index is a bad idea anyhow. If you're going to use a price level

target (and I do think it would be better than an inflation target), then you

don't want to use a price index that will be subject to shocks that are

volatile but persistent. A one-time increase in the price of oil should not

require a subsequent compensating decline in other prices to offset it (nor

should a one-time decrease in the price of oil require a subsequent burst of

inflation to offset it). Theoretical arguments would suggest using an index of sticky

prices, but the core is a reasonable approximation.

Here’s what my chart above looks

like when you use the core PCE price index instead of the headline index.

Very different. By this measure we are undershooting now no

matter when you start the target path.

And unless you cherry-pick the starting point in 2003 or 2011, the size

of the undershoot is not insignificant.

If you compare to the 1990’s, the Fed was already slightly behind when

the Great Recession began, and they have fallen further and further behind

since then. Price level targeting, using

the core price index, would require the Fed to promise a significant amount of

catch-up inflation in the coming years.

DISCLOSURE: Through my investment

and management role in a Treasury directional pooled investment vehicle and

through my role as Chief Economist at Atlantic Asset Management, which

generally manages fixed income portfolios for its clients, I have direct or

indirect interests in various fixed income instruments, which may be impacted

by the issues discussed herein. The views expressed herein are entirely my own

opinions and may not represent the views of Atlantic Asset Management. This

article should not be construed as investment advice, and is not an offer to

participate in any investment strategy or product.

252 comments:

1 – 200 of 252 Newer› Newest»The premise that the Fed was targeting core prices since 1993 is incorrect. They moved to core PCE deflator around the turn of the century.

In its "Monetary Policy Report to the Congress" ("Humphrey-Hawkins Report") from February 17, 2000 the FOMC said it was changing its primary measure of inflation from the consumer price index to the "chain-type price index for personal consumption expenditures".[3]

Well, they hadn't really started to settle on 2% either until around the turn of the century, so the whole idea of including the 1990's is questionable (and data on inflation expectations suggests that 2.5% would have been a more accurate estimate of their perceived CPI target). In any case the perception was always that the Fed would not be strongly influenced by one-time changes in food and energy prices. To some extent this was because they were perceived to focus on core prices, and to some extent it was because they were perceived to be targeting the inflation rate, rather than the price level, and were therefore not expected to compensate for changes that had already taken place. If they had been targeting the price level, it would not have made sense to use a headline index.

A government, a country should work as a house. We can not spend more than we earn and thus avoid debt.

Razas de Perro y Gatos

Mis Videos Preferidos en Youtube

I think that price level targeting by means of the core price index will cause the Fed to promise a significant amount of catch-up inflation in upcoming years.

Legitimate Typing Jobs Earn $250 Or More Daily Work At Home

With Hundreds Of Companies As A Home Typist. Never Pay Any Signup Fees To Work With These Companies. Work With As Many Companies As You Like For An Unlimited Income (Http://Tinyurl.Com/3gce3ot) Ids (11608)

I like your blog post. Keep on writing this type of great stuff. I'll make sure to follow up on your blog in the future.Very good, informative piece. Smartly done as all the time. agen bola, judi bola

Howdy this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding experience so I wanted to get guidance from someone with experience. Any help would be enormously appreciated.. agen sbobet

There is lot of information and they are very innovative and informative. I have read the article very well and it seems to me awesome. bola tangkas

Hello I must say for this well prepared information.I am now bookmarking this website for future reference.Keep up the good work.

Your post is quite informative for me

https://hedford.com

This is certainly very nice. Solitary stare upon tips subject matter when we are bowled over. We are curious about this sort of products. Solitary appreciate your guidelines, and number the effort in this. Please keep editing. togel online. togel online

I’m planning to get my nose straightened… I find this is good info for people who would try to know something about Wallet passbee Media

I got it my elucidation from over here. I very much urge his/her workings with the constructive enlightening information. Thanks a lot…Watersound real estate

I do think in which price degree concentrating on through the central price list causes the Feasted for you to guarantee an important number of catch-up inflation with upcoming decades. Apple Ibeacon

Always musicals and handled problems that impacted younger ladies of colour; this was an awesome interval of my lifestyle. Shauntay Allow, who is now a participant of. jual

In particular, individuals who claim that we are undershooting right now don’t seem to have much of an discussion unless they begin the focus on direction in 2008 or later. Agen Judi

The Buddhist way to all of this is quite authentic, really. Buddhism is aware of of that from the viewpoint of ego the possibilities of deficiency of way of lifestyle is generally difficult. ct bat removal

Demonstrates address all sections of the market (like AHR Expo) or focus on particular sections (various organization events) seem to be the most effective. WII ISO

Demonstrates address all sections of the market (like AHR Expo) or focus on particular sections (various organization events) seem to be the most effective. WII ISO

I've already started using some of them. There wasnt a major growth but my boobs were a little more plump and full. Disappointed that it did not include a miter guide. carpet cleaners rowlett tx

Richards worked as a Master Plumber before working at Viega, and has positive things to say about a career in plumbing. Richards became a product trainer at Viega after he was laid off from his job in 2010. “I saw the opening for the trainer position with Viega and after using their products. link m88

Surely the Fed could alter expectations of future monetary policy in such a way that the resulting increase in private spending would be enough to offset the decreased spending due to fiscal tightening. Just think, for example, if the Fed were to increase its long-run inflation target. additional info read

I am very much confident that this is very nice Posting done by you. I always find you your blog interesting. keep on posting such nice updates as become very important to impact your thoughts and content, the Facebook will give you this platform to show your statistic. http://janganmo.blogspot.com/2014/07/vizzyus-safety-url-monetize.html

There is a saying in the Zen personalized, “Birth and deficiency of way of lifestyle are the excellent problem.” That is where actual Buddhist perform out needs primary. more information to follow

Often it is the amazing deficiency of way of lifestyle of someone near that provides this home; and then the regularity of medical center trips and memorials gradually begins to select up amount, like a drumbeat in the forests. make sure you follow them

Heya, I stumbled onto your website when using the yahoo and google though trying to find this type of fairly very helpful write-up plus your write-up is apparently instead fulfilling to be able to my opinion. Printed Circuit Board Supplier

It took us three years to build the NeXT computer. If we'd given customers what they said they wanted, we'd have built a computer they'd have been happy with a year after we spoke to them - not something they'd want now.

Sleeping Tablets Online

The Fed has been missing its targets for inflation and unemployment for some time now; it's not clear why giving it another target to miss is supposed to be a panacea. truth about cellulite symulast

This is particularly essential since you would always have to take into account that the purpose you can industry your home is to pay off your excellent economical debt to avoid a residence foreclosure. Fast Property Sale

Diligence is the mother of good fortune.

Valium Online

I didn't do that, I'm still just beginning but I can see how valuable having more stitch options is going to be and I've already started using some of them. There wasnt a major growth but my boobs were a little more plump and full. fifacoins goedkoop

Selecting the right toy can seem frustrating, but it doesn't have to be. Here are some guidelines for getting the right toy. Look at brands. next page

This post is quite fantastic, i am completely agree with your statement

Leon Kennedy Costume

It's just a story we tell ourselves to explain how we got here. As Faulkner wrote in "Light in August": Memory believes before knowing remembers. plano cerec dentist

A totally thoroughly clean profits fortify is actuality a new financial situation fantastic if possible generally easily obtainable with show versions very own most current seeking deal with. A person access to get rid of a whole new modern day night day profits fortify in mere numerous practices. Needed, with your own particular specific particular most current STARTING UP linked with virtually any ATM. Or just, start using a current relieve provide you versions very own most current credit rating charge cards traits business taken care of on the non-public.check cashing in fresno online

The ones who tend to do what has to get done are usually the quiet, mousey types. They'll jump nine feet in the air when a car backfires, but they'll shiv granny and the five year old it that's what it takes.

Demibet.com Bandar Judi Agen Taruhan Online Judi Bola Casino Poker Domino Tangkas Togel Terpercaya Indonesia

Demibet.com Bandar Judi Agen Taruhan Online Judi Bola Casino Poker Domino Tangkas Togel Terpercaya Indonesia

Dragonpoker88.com agen texas poker dan domino online Indonesia terpercaya

that is cool data to understand, very helpful for me cara membuat twitter and Cara Membuat Facebook 2015

Much obliged to you for offering. It is truly helpful for me. I will propose it to my companions. Trust there will be all the more great posts here.

Visit: GED Diploma Online

Thank you for another essential article. Where else could anyone get that kind of information in such a complete way of writing? I have a presentation incoming week, and I am on the lookout for such information. agen sbobet terpercaya, agen bola terpercaya

Thanks for a very interesting web site. Where else could I get that kind of info written in such an ideal approach? I have a undertaking that I'm just now working on, and I've been at the look out for such information. agen bola online, agen sbobet online

Thanks, We have also been seeking info about that subject for a long time as well as your own is the better We have discovered until eventually at this point.

Good post. I learn some thing tougher on distinct blogs everyday. Most commonly it really is stimulating to learn to read content material from other writers and exercise a specific thing there. sepatu nike air max | jual new balance murah

It’s in reality a great and helpful piece of info. I’m satisfied that you simply shared this useful info with us. Please keep us up to date like this tas hermes terbaru | tas chanel kw

Kathy Little considers she wouldn’t have to invest so lots of your power and effort as a resident regulating agency if certain condition and govt authorities would phase up and do their job.Foothills Flowers

Hello, I have browsed most of your posts. This post is probably where I got the most useful information for my research. Thanks for posting, maybe we can see more on this. vitamin d präparate

Thanks for this good article.

Very nice post. I added my bookmarks this blog.

The global inflation made it difficult for people to afford the traditional education and they were forced to work in field for self-sufficiency and after a long span time being spent in the industry they were not able to claim growth and promotion. The issue finally got addressed through life experience degree which proved to be the best solution.w

Pretty nice post I simply stumbled upon your website and wished to mention that I've actually enjoyed browsing your website posts.

Very good and informative article, thanks for this posting..

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it….

Mau tampil keren dan menawan dihadapan semua orang, pakai saja jam tangan original ziendi shop di blog ini yang menawarkan berbagai merk jam tangan keren dan murah untuk cowok maupun cewek. kalau kamu tidak memiliki uang untuk membeli, ya kerja dahulu gan. sebab saat ini peluang bisnis terbuka lebar terutama UKM, dan ukm sering kali memanfaatkan bisnis percetakan yang membutuhkan mesin fotocopy sebagai alat untuk menggandakan file. kalau kamu mau beli atau sewa fotocopy lihat dulu harga terbarunya selengkapnya disini. terdapat berbagai merk dengan harga bersaing, namun untuk yang kuat produk dari jepang dan diproduksi di dalam negeri ialah fotocopy copystar dan kyocer, lihat disini untuk update harga mesin fotocopy tersebut. kalau kamu mau, silakan beli di toko terdekat ya. di toko itu biasanya juga menjual perkakas lain dalam hal ini mesin bubut. mesin bubut kayu memiliki harga yang bervariasi, kamu bisa klik disini untuk informasi terbaru mengenai mesin pemotong ini. selain itu mesin bubut kayu juga sering digunakan oleh pengrajin furniture dan meubel loh gan, jenis dan daftar harganya bisa kamu baca disini untuk yang mesin penghancur kayu tersebut. temukan pula beberapa informasi terhangat di sekitar kita misalnya tentang puasa rajab yang banyak mengandung simpang siur hukumnya, namun bagi yang ingin membaca niat puasanya, bisa kunjungi ini yang memberikan manfaat dan juga cara bacaan puasa rajab.

Mau taruhan online dengan biaya deposit murah dan hemat, kamu bisa melihat selengkapnya disini karena taruhan bisa dilakukan dengan mengeluarkan uang sedikit sekali hanya 25rb. sebagai agen judi bola terpercaya di indonesia yang kini mendapat kepercayaan yang besar dari masyarakat, jagobetting selalu mengeluarkan beberapa kebijakan baru seperti promo dan juga bonus mingguan

An extremely wonderful blog entry we are truly appreciative for your blog post.

I would like to thank you for the efforts you have made in writing this article.

Very interesting blog. Alot of blogs I see these days don’t really provide anything that I’m interested in, but I’m most definately interested in this one. Just thought that I would post and let you know.power case

I really appreciate the author's insight about the topic. While going through the article, the readers will get an idea about increased structural unemployment. It is a good stuff for reference!

The first mobile bar for rent with newly designed and fully customized mobile bar with LED that suit to everyone let us party bring friends and love ones to enjoy

this is a good explanation to the concept. i clearly understood what you are trying to tell.

cool whatsapp status

this is useful information, it will help me a lot in my studies, i am an economic student so this has given me a new perspective to think.

interesting facts

He was never charged, and when broken down where he bought facebook entrar perfil , facebook entrar mi cuenta , facebook entrar login , girlsgogames , facebook entrar perfil , facebook entrar mi cuenta , facebook entrar login

Money should be spent sweat tears kept only have things not even buy dc pecuniary cares coolmath games , descargar whatsapp para android , baixar whatsapp para celular , baixar whatsapp gratis , coolmath4kids , descargar whatsapp plus gratis , baixar whatsapp plus

happy halloween wallpapers HD

scary halloween quotes for kids

halloween date in usa uk australia india

history of halloween 31 october 2015

very good post.

----

juegoskizi | jogos friv |

jogos do friv | jogos click | juegos de pou | juegos de terror | jogos online |

unblockedgames

With a nice and interesting topics. Has helped a lot of people who do not challenge things people should know. You need more publicize this because many people. Who know about it very few people know this. Success for you....!!!

I hope you post again soon.

descargar mobogenie gratis and apply baixar facebook gratis and apply mobogenie baixar online free and apply facebook descargar and apply facebook descargar gratis and mobogenie descargar and whatsapp descargar gratis and gratis whatsapp |

descargar mobogenie | agar io | agario | five 4 | h1z1 maps | Gmod free

Kya kool hai hum 3 dvdrip 720p free download

Quickbooks support phone number

Intuit Quickbooks Online

brothers torrent download

Quickbooks Support Phone Number

Quickbooks online canada

quickbooks pro advisor

Intuit Quickbooks Support Online

Computer tech support number

Need an extra income? Just visit our website.

Puli Tamil Movie 720p free download

Great write about "Inflation vs. Price Level Targeting" so nice post i have got here thanks.

Great stuff. This is really a fascinating blog, lots of stuff that I can Get into. One thing I just want to say is that your Blog is so perfect

happy wheels ez

super mario bros

pacman

agario

This information processing system is actually a walk-through for all of the data you needed concerning this and didn’t recognize WHO to raise. Glimpse here, and you’ll positively discover it….

Agen Bola Sbobet

Agen Bola Online

Inflation increases menu costs that enterprises must bear. As high inflation, corporate expenses increased rapidly due to changes in price several times during the period.!

Dora , Kizi new , G9g , 4 games , 85 jogos , Friv 4 , kizi 2 , Huz , 85 Play

Gembrot Jasa SEO dan Optimasi Website Situs / Blog layanan Jasa SEO terukur dan tepat sasaran untuk bisnis maupun promosi

Apakah kamu mencari seorang pakar seo ? siapakah itu pakar seo ... jasa seo murah garansi gembrot jasa seo dan optimasi website: http://blog.andyharless.com/2013/01/inflation-vs-price-level-targeting.html

Bagi anda yang memiliki usaha di wilayah Depok dan Jakarta ... plus jasa seo murah garansi gembrot jasa seo dan optimasi website: http://distributorseo.blogspot.com/2015/10/gembrot-jasa-seo-dan-optimasi-website.html

Best selling self Balancing scooters

Halloween Spooky Quotes

Halloween Witches Pictures

Halloween Background

Halloween Clipart

Preschool Halloween Crafts

Cool Halloween Pictures

Halloween Scary Quotes

Halloween Cartoon Pictures

Halloween Colouring Pictures

Halloween Flyers

Halloween Pumpkins Pictures

Images Halloween

Halloween Images Free Download

Creepy Halloween Pictures

Halloween Pumpkin Pictures

Pictures Halloween

Halloween Party Pictures

Photos Halloween

Halloween Funny Pictures

Halloween 2015

Halloween Scary Pictures

Halloween Pictures to Draw

Spooky Halloween Pictures

Halloween 2015 Pictures

Dilwale box office collection

Dilwale box office prediction

Dilwale box office Total Collection

Dilwale 1st day collection

Dilwale 2nd day collection

Dilwale 3rd day collection

rose day 2016 shayari sms

rose day shayari sms in hindi

7th feb rose day sms

rose day 2016 romantic sms

happy rose day romantic shayari

valentine day special whatsapp short video

rose day whatsapp short video

rose day whatsapp dp

rose day whatsapp dp images

rose day romantic sms for girlfriend

happy rose day sms wallpaper

Happy New Year 2016 FB Messages in English

Happy New Year 2016 FB Messages in Hindi

Happy New Year 2016 FB Shayari in Hindi

Happy New Year 2016 FB Status in Urdu

happy new year 2016 animated videos

happy new year 2016 whatsapp videos

happy new year 2016 whatsapp short videos

happy new year 2016 fb animated images

happy new year 2016 fb GIF images

happy new year shayari

happy new year 2016 shayari sms

happy new year shayari images

happy new year 2016 sms images

happy new year 2016 sms wallpaper

valentines day 2016 romantic quotes

romantic valentines day 2016 quotes for her

romantic valentines day 2016 quotes for girlfriend

happy valentines day 2016 romantic SMS

Valentines Day 2016 Romantic Wishes for Boyfriend

Valentines Day 2016 Romantic Sayings for gf

happy valentines day 2016 romantic messages for gf

happy valentines day 2016 romantic images

romantic Valentines Day 2016 E Cards

valentines day romantic 2016 FB Covers

happy valentines day 2016 Romantic FB Status

valentines day 2016 romantic sayings for Boyfriend

Frohe weihnachtsgrüße 2015

Forhe Weihnachtsgeschenk für freundin

Forhe Weihnachtsgeschenk für freund

Forhe weihnachtsgeschenke für eltern

Frohe weihnachten 2015 russisch

frohe weihnachten russisch

Weihnachtsgeschenke 2015 für eltern

weihnachtsgeschenke für eltern 2015

Weihnachten 2015 wünsche

Weihnachtsgeschenk 2015 für freundin

Gedichte zu weihnachten 2015

Gedichte weihnachten 2015

Gedichte Forhe weihnachten

sprüche zu weihnachten 2015

Frohe weihnachtsgrüße 2015

Weihnachten im schuhkarton 2015

Frohe Weihnachten 2015 Bilder

Forhe weihnachtsgeschenke für männer 2015

Frohe weihnachten 2015 spanisch

Frohe weihnachten 2015 französisch

Frohe weihnachten 2015 italienisch

Frohe weihnachten und ein gutes neues jahr 2016

Sprüche zu weihnachten 2015

Geschenke weihnachten 2015

با مراجعه به محل جهت تعمیر یخچال صرفه جویی در وقت صورت می گیرد. اگر احساس می کنید تعمیر یخچال در محل نیاز دارید سرچ کنید.$nbsp;اعتماد کردن به تعمیرکار یخچال این روزها سخت است. کرکره اتوماتیک نام دیگر درب کرکره ای تلقی می شود. فروش و نصب کرکره برقی با هزینه ای مناسب.$nbsp;انواع کرکره با تیغه کرکره کیفیتش سنجیده می شود. پساتحریم به اقتصاد مقاومتی وابسته است . در سایت خبری آتیسام عناوین اخبار اقتصادی در ایران و جهان دنبال کنید . اقتصاد هر کشور نبض تپنده آن کشور است .$nbsp;عناوین امروز : این روزها شاهد خبرهای متفاوتی از رشد اقتصادی هستیم . به امید پویایی اقتصادی ایران عزیز پساتحریم به اقتصاد مقاومتی وابسته است . برای تبلیغ بعضی موسسات ترجمه ارزان راهکار مناسبی به نظر نمی رسد.$nbsp;عناوین امروز : این روزها شاهد خبرهای متفاوتی از رشد اقتصادی هستیم . به امید پویایی اقتصادی ایران عزیز را در دامنه دات آی آر آتیسام دنبال کنید . اخبار ایران : به گزارش پایگاه اطلاع رسانی آتیسام اخبار ایران و جهان دیروز : سیل مناطق وسیعی از مازنداران بوقوع پیوست که خسارات جانی و مالی را در پی داشت .$nbsp;ایران یکی از با نفوذ ترین کشور های جهان است . نحوه ارسال مقاله براي مجلات بين المللي IS آگاهی از طریقه انتشار مقاله در مجلات داخلی و خارجی امر مهمی محسوب می گردد.$nbsp;انتشار و چاپ مقالات در نشریات معتبر با نمایه بین المللی ISI و SCOPUS پايان نامه کارشناسي ارشد و انجام پايان نامه دکتري تز پایانی یا انجام پایان نامه خود را به افراد با تجربه بسپارید.$nbsp;پروپوزال کارشناسی و ارشد، پایان نامه مدیریت،انجام پروژه های دانشجویی طرح پژوهشی را به کتاب تبدیل می کنند. موسسه موجک تبدیل پایان نامه به کتاب را در تهران می تونه انجام بده.$nbsp;گروه Thesis Publication به عنوان یکی از اولین و تخصصی ترین مراکز تبدیل پایان نامه به کتاب استخراج کتاب از پایان نامه|استخراج مقاله از پایان نامه فعالیت ... تدوین کارای حمید شکربار خداییش خیلی خوبن ، من که راضیم . عروسیتون نزدیکه ؟ دوست دارید مراسمتون حرفه ای عکاسی و فیلمبرداری شه ؟ پس مفتخریم آتلیه عروس و داماد شکربار در شرق تهران در خدمت شماست .$nbsp;بچه ها جونم آتلیه حمید نمونه کاراش عالیه شما هم تایید کنید خیالم راحت میشه .

No no doubt that could not deny the importance

http://www.certifiedcaliforniadentist.com

i am visiting first time to your blog awesome post you have written, thank for sharing

Dilwale Box Office Collection

Dilwale Torrent

Airlift Box Office Collection

Natsamrat Torrent

thanks for it

Feliz Año Nuevo 2016 WhatsApp Videos

ukprivateinvestigators.com

very good work..

top site

budidaya jahe merah

jahe merah

budidaya jahe merah

budidaya jahe merah

budidaya jahe merah

budidaya jahe merah

budidaya jahe merah

budidaya jahe merah organik

bibit durian unggul

budidaya durian unggul

bibit durian bawor

budidaya tanaman durian

bisnis durian

bibit durian

bibit durian

budidaya durian

bibit durian bawor

manfaat durian

bibit durian unggul

bibit durian montong

bibit durian sunan

bibit durian petruk

bibit durian

that is very nice work by the author. limo rental Elizabeth

hi it is very nice thanking you

lohri images 3D wallpapers

lohri photos 3D wallpapers

happy lohri photos 3D wallpapers

download happy rose day wallpaper

rose pics free download

rose images for valentines day

rose day pics

free rose pics

happy rose day hd images

happy rose day images hd

happy rose day hd wallpaper

happy rose day wallpaper hd

happy rose day hd picture

hd happy rose day

happy rose day images with quotes

best rose day quotes

rose day wishes quotes

rose day romantic quotes

best quotes for rose day

red rose images with quotes

happy rose day pics with quotes

rose wallpapers with quotes

rose day wallpaper with quotes

rose day best quotes

rose day quotes in english

best quotes on rose day

beautiful red rose quotes

rose pics with quotes

Good post

republic day image

republic day photos

republic day speech

Valentines Day Gifts For Her

Cute Valentines Day Wishes

Good Friday Wishes

Valentines Day Love Letters

Easter Day Quotes

Valentines Day 2016 Cards

Valentines Day WhatsApp Status

Valentines Day 2016 Love SMS

Valentines Day 2016 Sms For Boyfriend

Valentines Day Sms Collection

Valentines Day 2016 Romantic Pic Of The Day

The topic you are pointing out is a good topic. This type of writing always been my inspiration. marathi shayari for lovers

whatsapp status, life status, love status, sad status, funny status

Please let me know if you’re looking for a author for your weblog. You have some really great articles and I feel I would be a good asset. If you ever want to take some of the load off, I’d love to write some articles for your blog in exchange for a link back to mine. Please send me an e-mail if interested. Thanks! Mesin Bakso

I’m not sure where you are getting your information, but good topic. I needs to spend some time learning more or understanding more. Thanks for excellent information I was looking for this information for my mission. Baju Muslim Terbaru

Exceptional post but I was wanting to know if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit more. Cheers! Sewa mobil di malang

Hey! I know this is kinda off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having problems finding one? Thanks a lot! usaha laundry kiloan

Nice post !!! I actually added your blog to my favorites list and look forward to get the same quality content every time I visit your blog. selling videos online

Thanks for this informative article! You give very understandable explications and relevant data.

Untuk anda yang membutuhkan karangan bunga jakarta, silahkan hubungi kami melalui nomor kontak yang anda agneta.

Bayi lelaki itu tumbuh amat cepat. Ia begitu kuat nafsu makannya. Walau masihlah bayi, nafsu makannya sudah setara dengan sepuluh orang dewasa Paket Tour Bali. Bersamaan bergulirnya sang saat, si bayi beralih jadi kanak-kanak. Begitu besar badannya serta semakin bertambah kuat nafsu makannya. Ia juga dinamakan Kebo Iwa, paman kerbau arti namanya.

Jadi tambah hari jadi tambah besar badan Kebo Iwa. Jadi tambah kuat juga nafsu makannya Paket Liburan Bali. Satu hari keperluan makannya sama juga dengan keperluan makan seratus orang dewasa. Ke-2 orangtuanya betul-betul kewalahan penuhi keinginan makan Kebo Iwa Paket Tour.

No matter how you look at it, services such as khasiat susu kambing googledrive and dropbox only provide 5gb of cloud storage, Jasa SEO Murah Bergaransi Halaman 1 Google thus as a user you are extremely limited. I recommend you guys check out 4sync, they offer 15gb of free storage and arguably have the best access across all platforms see: outbound bandung.

Selain itu anda juga bisa melihat pemakaman mewah di san diego hills yang banyak diminati oleh orang orang berduit di negara ini. Anda bisa membuktikannya dengan mengunjungi website tersebut. - lukis dinding

اولین مجموعه آموزشی حقوق مدنی

از دوره آموزشی 8 ترم تحصیلی رشته حقوق در دانشگاه میباشد

در حقوق مدنی 1 : شما با مباحث مقدمه علم حقوق + اموال و مالکیت آشنا خواهید شد .

مراحل وضع قانون و حقوق تجارت

چیست ؟ و چه زمانی بصورت یک قاعده حقوقی لازم الاجرا در خواهد آمد ؟

با استفاده از درب اتوماتیک

، ورودی ساختمان ها مدرن، زیبا و ایمن می شود و تأثیر بسیاری در جلوگیری از اتلاف انرژی دارد. همچنین دلیل مهم دیگر استفاده از این در ها، رعایت بهداشت عمومی و خصوصی بالاخص در بیمارستان ها و مراکز درمانی می باشد.:

درب های اتوماتیک:

کشویی منحنی گردان تاشو تلسکوپی مثلثی اضطراری لولایی بیمارستانی

Fan Movie Box Office Collection

Raees Movie Wiki

Fan 1st Day Collection Business

India Vs New Zealand 15 March 2016 T20 Match

Download Facebook

Holi 2016 Greetings In Hindi

Mothers Day Wishes Greetings

Happy Birthday Images My Love

Good Night Hd Images

I also like some of the comments too. Waiting for the next post. bus rental Brooklyn

Best Quotes

trimakasih atas bantuanya

obat bius

Its a great pleasure reading your post.Its full of information I am looking for and I love to post a comment that "The content of your post is awesome" Great work

Cnbola.com

www.cnbola.com

Cnbola

Cnbola.com

Once you are well-informed about the real estate market and the selling process, selling your own home will become less stressful. Knowing how to navigate your way through this process is a wonderful skill.auto accident attorney plantation

This post is very simple to read and appreciate without leaving any details out. Great work! You completed certain reliable points there. I did a search on the subject and found nearly all persons will agree with your blog.

http://downloadmyfileshere.com

Hey what a brilliant post I have come across and believe me I have been searching out for this similar kind of post for past a week and hardly came across this. Thank you very much and will look for more postings from you.

http://bestdownloadablefreeware.ru

http://downloadallstuffs.com

http://downloadmyfileshere.com

mesin digital printing

mesin cutting laser

Thank you for your post.

Blakeslee and Son really helped us out when we had a plumbing issue. We are in Grand Rapids and would highly recommend their services!cheap priced ATVs

Keep on setting up. I am certain this post has helped me spare numerous hours of perusing other comparative post just to discover what i was searching for.

I would love to stop by. But, I think it might have to wait until this summer. I did not know that Serlkay had ever expanded its size. I must say that a succesful family owned business in this.gospel tract

Jual Payung Promosi

Dokter Ahli Bedah Tulang

very good article and interesting also

I most likely appreciating each and every bit of it. It is an incredible site and decent impart. I need to much obliged. Great employment! You all do an incredible blog, and have some extraordinary substance.silicone coin purse

Travel Pekanbaru Padang

Mothers Day Wishes Greetings

Mothers Day 2016 Images Download

Download Mothers Day Greetings

Download Mothers Day Images

Download Mothers Day Pictures

Download Mothers Day Photos

Download Mothers Day Pics

Download Mothers Day Wallpapers

Its a great pleasure reading your post.Its full of information I am looking for and I love to post a comment that "The content of your post is awesome" Great work.limo rental Las Vegas

Mothers Day wonderful wallpaper

happy mothers day wallpapers

memorial day activities for adults

in usa

memorial day activities for adults

تتنوع العاب فلاش وذلك على حسب كل شخص ورغبته فهناك عدة انواع منها وهناك من هي خاصة بالبنات واخرى للاولاد وتعتبر العاب تلبيس من اكتر الالعاب انتشارا في الويب وهي محبوبة عند الجميع ولديها جمهور واسع كما انها سهلة اللعب والجميع يمكنه لعبها بسهولة تامة بدون صعوبات تذكر كما ان هناك انواع اخرى متل العاب طبخ والعاب اكشن ومكياج و سيارات الى غير ذلك فلك صنف جمهوره ومحبيه ولكن تبقى العاب بنات الاكتر انتشارا وشعبيتنا في عالم العاب الفلاش كما انها تحتوي على شخصيات معروفة وغنية عن التعريف متل باربي و سندريلا وشخصيات اخرى تركت بصمتها في هذا المجال لهذا اصبح يعتمد عليها كتيرا في صنف العاب تلبيس بنات الدي تحبه البنات بكترة خاصة في العالم العربي مما يجعل المواقع الخاصة بهذا النوع تزداد يوما بعد الاخر فذلك ليس عبثا ففي الحقيقة نوع العاب التلبيس من اجمل اصناف العاب فلاش بصفة عامة و العاب بنات بصفة خاصة.......

Although many paperwork which have been key resources continue in non public arms, the typical location for the children can be an save. These types of is usually community as well as nonpublic.www.Q9PowerSports.com

Thanks for the informative writing. Would mind updating some good tips about it. I still wait your next place.nelson tree service ny

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

Ccoc.cmes.tn.edu.tw

My.sitemark.com

Photozou.jp

Bata Expose | Dak Keraton

Great post! I am actually getting ready to across this information which i found very interesting to read.

Bata Expose

Dak Keraton

jika ini adalah komentar spamer maka saya rasa tidak mungkin untuk situs sebagus ini terlebih lagi yang berkomentar di sini adalah para jasa seo dan saya hanya mengikuti apa yang mereka lakukan

I finally found a long article I was looking

Just like in brick and mortar stores you can also find discount shopping online as like anything else you can find anything you want with only a few clicks of the mouse. While the brick-and-mortar is a plus for getting outdoors it can also be inconvenient and stressful.CWDM Mux/DeMux Module

http://eyesdisplay.com/waktu-masa-subur-pria/

hdfc loan against securities status

bob net banking login

Poker Online Uang Asli

Situs BandarQ

Judi Domino 99 Terpercaya

jual obat klg

jual obat klg asli

jual obat klg asli bergaransi

jual obat klg asli super

jual obat klg terbaik

jual obat klg terlaris

klg asli pembesar

klg asli pembesar penis

klg asli pembesar penis bergaransi

klg asli pembesar penis super

klg asli pembesar penis terbaik

klg asli pembesar penis terlaris

Good one article.

Quickbooks Support phone Number

olympics closing ceremony live

Thanks for Sharing Hindi Shayari, Navratri Quotes, Love Status in Hindi, Diwali SMS Messages,

Il nuovo spettacolo di ricerca che i prodotti a base di ginseng può davvero migliorare la vita l'amore di un uomo. Un risultato molto migliore rispetto a quelli che prendono pillole per l'erezione. Oltre il 40 per cento degli uomini che prendono queste pillole di erezione effettivamente vedere alcun miglioramento a tutti. curare la disfunzione erettile

Il portale inglese tutor di scrittura per il noleggio in grado di fornire tutti i materiali necessari che vi darà tutte le informazioni importanti è necessario su segni di punteggiatura come virgolette, parentesi, virgole, due punti, punto e virgola, trattino, parentesi e segni di interpunzione finali. come affrontare il colloquio in inglese modello

Gli insegnanti dovranno essere insegnato inglese in primo luogo, in modo che siano ben preparati per insegnare l'inglese, a sua volta. Si tratta di andare a prendere il tempo che si rivelerà costosa per gli studenti. A parte le scuole, il governo interessato può corda nei servizi delle ONG per lo scopo anche se la portata delle ONG saranno limitati, visto i vari vincoli. colloquio di lavoro in inglese lavorare a londra

Impotenza significa l'incapacità di sviluppare o mantenere l'erezione. Farmaci per via orale sono pillole come il Viagra che viene preso circa un'ora prima dell'attività sessuale. erezioni vigorose senza farmaci

New Year Wishes Quotes

New Year SMS Messages

New Year Images Wallpapers

Se il vostro corpo non riesce a produrre ossido di azoto abbastanza, non sarà possibile ottenere un'erezione a tutti, per non parlare di una più dura. Il motivo per cui questa sostanza naturale è così importante, è che si allarga i vasi sanguigni che portano nel pene in modo più sangue può entrare e rendere difficile. cure per disfunzione erettile

È necessario dire che questo - in una o due frasi piani - upfront. Questo dà il tono per il resto della lettera. Non si sta scrivendo su un posto di lavoro, si sta scrivendo, perché hanno bisogno di te. Se fate bene il vostro caso, il lettore non sarà in grado di aiutare a guardare tergo al vostro CV e vi sarà un passo avanti verso l'intervista. agenzie per il lavoro londra

Infatti, i risultati precedenti, adottando la strategia del 'Chipko' incoraggiato gli abitanti del villaggio a chiedere per la gestione di consultazione e democratica delle risorse condivise, una maggiore responsabilità e lo sviluppo dannose per l'ambiente. colloquio in inglese

This is to inform you that ISL Live Streaming is going on in HD Quality . You way watch here.

isl live 2017

indiansuperleaguelive.org

Thank you for another fantastic post

togel

Thanks for a very interesting web site. Where else could I get that kind of info written in such an ideal approach? I have a undertaking that I'm just now working on, and I've been at the look out for such information. berita terpercaya, resep masakan istimewa dapur ibu , bursa loker terpercaya

Love this post! Cooking eggs always seems easy but it’s not as easy as it sounds. Maybe you could share your tips on perfect scrambled eggs.boat rental miami

ennjoy artikel for you

Free VST Plugins Download

New Year Resolution Images

New Year Images Free Download

New Year'S Eve Images Free

Happy New Year Wallpapers

Happy New Year 2017

New Year 2017 Quotes

Happy Diwali 2016

Sad Whatsapp Status

Love Whatsapp Status

New Year 2017 Wishes

Love Status in Hindi

You know your activities emerge of the group. There is something exceptional about them. It appears to me every one of them are truly splendid Jasa SEO Bergaransi

I will share this information to everyone............

happy new year wishes quotes to friends

Awesome blog. I enjoyed reading your articles. This is truly a great read for me. I have bookmarked it and I am looking forward to reading new articles. Keep up the good work!

best valentine quote

valentine week list 2017

valentines day cards greeting

happy valentine day 2016 wishes

romantic love letter for valentines day

valentines whatsapp status messages

happy valentine's day sms 2017

happy valentines day funny images

you make blogging look easy. The overall look of your web site is fantastic, as well as the content! prediksi togel hari ini | Poker Online

very interesting post at all. I really liked this post DewaPoker, judi online

Thank you for another fantastic posting. Where else could anyone get that kind of information in such a perfect way of writing? I have a speech next week, and I was looking for more info ;) Agen Bola | Dewa Poker

nice blog i like it ,very interesting Togel ||Togel sgp

That appears to be excellent however i am still not too sure that I like it. At any rate will look far more into it and decide personally!

That appears to be excellent however i am still not too sure that I like it. At any rate will look far more into it and decide personally!

coach outlet store online clearances

houston rockets jerseys

miami heat jerseys

michael kors outlet clearance

nike shoes

cheap mont blanc

ralph lauren outlet

adidas superstar

longchamp bags

adidas yeezy

20170320caiyan

coach outlet

coach outlet

yeezy 350 boost

coach factory outlet

adidas superstar

michael kors outlet online

louboutin pas cher

adidas outlet

kd 9 shoes

huston texans jerseys

20170320caiyan

The Best Article

Agen Piala Dunia 2018

Agen Taruhan Maxbet

This is very much satisfied by the great info is visible in this blog and I am searching the great info is visible in this blog.

casino review

ink bingo

russian roulette

This is really very much enjoyed for the nice technology is visible in this blog and thanks a lot for the providing the amazing info is visible in this blog and the nice approach is visible in this blog.

russian roulette

free casino

casino online

I am really very happy for the nice info is visible in this blog. This is really impressive with this blog and the nice technology.

gambling online

bet online

gambling games

This is very much happy for the nice approach is visible in this blog and the nice technology.

betting sites

gambling online

bet online

Thank you for this quality economic analysis. It was really helpful for my school work.

Yahoo Mail Sign Up

I consider this article to be very insightful and helpful for all those who have been experiencing troubles studying economics. I have read the article carefully and I must say that I want to use the material when writing my essay with the help of the NYCResumeServices.com on economic issues.

This is an incredible content. I never regretted any moment that came to your blog! Keep posting like this.

Godaddy Coupon Code

You ought to dependably explore the organizations on the BBB site before choosing to go into an agreement with them. This gives you a chance to see with your own eyes whether the loan specialist you are thinking about is a decent decision. This ought to give you more simplicity of mind at whatever point you apply for a credit.

A basic strategy to discover legitimate payday advance moneylenders to look on sites that audit them. You can get data on which organizations are dependable and which ones have shady practices that you ought to dodge. On the off chance that set on getting payday advances, survey all data before marking an agreement.

While considering representative correspondence the manager needs to attempt and put aside some general calendar time possibly once consistently to converse with representatives including administration about what is happening at the work environment regardless dissertation help services uk. In this circumstance the business can ask particularly what obligations does the representative have and how can he execute them. Perhaps together both, business, directors and workers can concoct better arrangements of productivity and methodologies of change to improve things for the representative too. On the off chance that there are any real work environment changes that influence the representatives right now is an ideal opportunity to discuss them.

It help me very much to solve some problems. your blog is very informative thanks for sharing it

Bangalore Escorts

Delhi Escorts Girls

One government, one country should work like a house. We can not spend more than we earn and avoid debt.

This post is very simple to read and appreciate without leaving any details out. Great work!

شركة صيانة مسابح بالخبر

شركة تنظيف بيارات بالخبر

Excellent post..

Anniversary wishes for wife

Merry Christmas & Happy New Year Sayings

Obat TBC

Obat sipilis

Obat Wasir Herbal Ambejoss

Efek Obat Tbc Kelenjar

Efek Obat Tbc Pada Anak

Efek Obat Tbc Pada Kulit

Efek Obat Tbc Pada Ibu Hamil

Obat Tbc Generik

Borong Kerja Rumah Malang

thanks for your share information

This blog contain full of information....thank you..bitcoin price prediction

Everybody experiences times of monetary pain. In many cases, we hurry to end this wretchedness and move beyond the circumstance at the earliest opportunity. check cashing near me san diego

Payday advance is a bland name to a moderately new type of loaning cash. The name is gotten from the way that the credit is reimbursed in full in the following paycheque of the borrower, consequently the name payday advance. check cashing near me san diego

Leave your comment Please prove you're not a robot

Diverse states have changing laws about how moneylenders can structure their automobile title credits. In California, the law forces financing cost tops on little advances up to $2,500. Notwithstanding, it is conceivable to get cash in abundance of $2,500, if the security vehicle has adequate esteem. In these circumstances, banks will commonly charge higher loan costs.

20180604 junda

burberry outlet

world cup jerseys

mavericks jerseys

ugg boots

nhl jerseys

ferragamo shoes

canada goose coats

air max uk

michael kors outlet

mulberry handbags

20180604 junda

burberry outlet

world cup jerseys

mavericks jerseys

ugg boots

nhl jerseys

ferragamo shoes

canada goose coats

air max uk

michael kors outlet

mulberry handbags

moncler sale

cheap nfl jerseys

balenciaga speed

nike shoes for men

balenciaga sneakers

outlet golden goose

hermes belt

pureboost

nike flyknit trainer

stephen curry shoes

pandora jewelry

iniki

westbrook shoes

pandora bracelet

jordan retro 13

lacoste outlet

adidas yeezy

fila shoes

michael kors handbags

bape clothing

When they call simply give them the data for the organization that is speaking to you and let them realize that the obligation will be reimbursed to them as a component of an advance/obligation union program you have started. cash advance online san diego

Post a Comment