I don’t have time for a real blog post, but here’s a quickie

in an attempt to keep this blog alive.

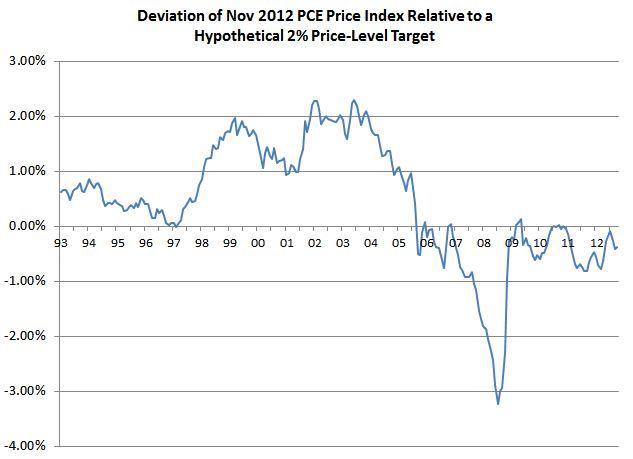

Dave Altig and Mike Bryan of the Atlanta Fed’s Macroblog

argue here that it wouldn’t make much difference if the Fed

were doing price level targeting (in which the future target path stays fixed

even when you miss a target, so you need catch-up inflation or catch-up

disinflation) rather than inflation targeting.

Their evidence is mostly from a chart like this (my replication using

monthly data, which you can confirm looks fairly similar to theirs which

appears to use annual data):

Quoting from their blog post:

Consider the first point on

the graph, corresponding to the year 1993….This point on the graph answers the

following question:

By what percent would the actual level of the personal consumption expenditure price index differ from a price-level target that grew by 2 percent per year beginning in 1993?

The succeeding points in the

chart answer that same question for the years 1994 through 2009.

In my case, as I said, it’s

monthly, and it goes all the way to 2012, but the idea is the same.

OK, fine. So here it looks like a price level target

would have produced roughly the same results as the Fed’s (unofficial until

January 2012) inflation target, and whether it would have undershot or overshot

depends on when you start the target path.

In particular, people who argue that we are undershooting right now

don’t seem to have much of an argument unless they start the target path in

2008 or later.

BUT…

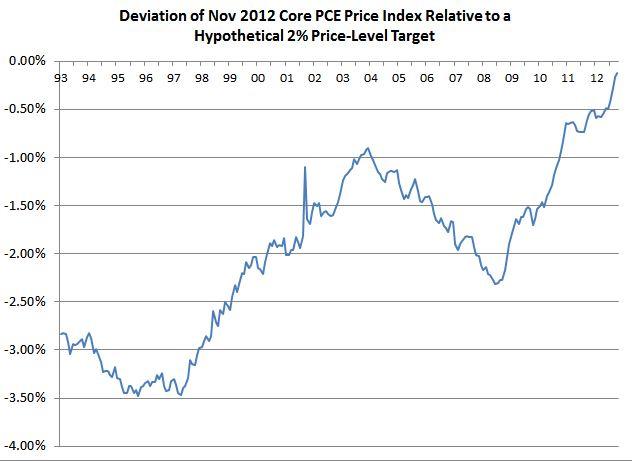

The problem with this chart is that

it uses the headline PCE price index, whereas during most of this time (until

January 2012 when the official inflation targeting policy was introduced), the

Fed was perceived to be targeting core

PCE inflation (excluding food and energy, that is), not headline

inflation. Price-setters were making

their decisions largely under that assumption.

It makes no sense to go back to 1993 and set up a target path using the

headline price index when that index was irrelevant to the policy that the Fed

seemed to be following at the time.

Moreover, targeting the price level

using the headline price index is a bad idea anyhow. If you're going to use a price level

target (and I do think it would be better than an inflation target), then you

don't want to use a price index that will be subject to shocks that are

volatile but persistent. A one-time increase in the price of oil should not

require a subsequent compensating decline in other prices to offset it (nor

should a one-time decrease in the price of oil require a subsequent burst of

inflation to offset it). Theoretical arguments would suggest using an index of sticky

prices, but the core is a reasonable approximation.

Here’s what my chart above looks

like when you use the core PCE price index instead of the headline index.

Very different. By this measure we are undershooting now no

matter when you start the target path.

And unless you cherry-pick the starting point in 2003 or 2011, the size

of the undershoot is not insignificant.

If you compare to the 1990’s, the Fed was already slightly behind when

the Great Recession began, and they have fallen further and further behind

since then. Price level targeting, using

the core price index, would require the Fed to promise a significant amount of

catch-up inflation in the coming years.

DISCLOSURE: Through my investment

and management role in a Treasury directional pooled investment vehicle and

through my role as Chief Economist at Atlantic Asset Management, which

generally manages fixed income portfolios for its clients, I have direct or

indirect interests in various fixed income instruments, which may be impacted

by the issues discussed herein. The views expressed herein are entirely my own

opinions and may not represent the views of Atlantic Asset Management. This

article should not be construed as investment advice, and is not an offer to

participate in any investment strategy or product.